It is not yet known how many workers in receipt of the Pandemic Unemployment Payment and Temporary Wage Subsidy Scheme will face a tax bill at the end of the year, but those who do will see their tax credits cut next year and possibly the year after. Such was the response of the Minister for Finance to a Dáil question (See Appendix 1) put to him last week, whereby he was asked for “the estimated number of taxpayers in receipt of the Temporary Wage Subsidy Scheme who will have an additional tax, USC and/or PRSI liability as a result at the end of 2020, and the average amount liable”. He was also asked for “the number of taxpayers on the Pandemic Unemployment Payment who are projected to have an additional tax, USC and/or PRSI liability at the end of 2020 as a result of receiving same, and the average amount liable”.

Experts at Taxback.com say that although the reduction in tax credits, which will equate to a reduction in take-home pay, had been eluded to in recent weeks, this was the first confirmation they had seen of the intended approach. The tax refund specialists say the Minister’s comments now give some clarity to concerned workers as to how any underpayment of tax will be resolved.

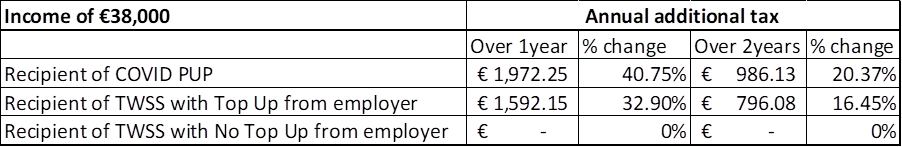

Based on this update, Taxback.com ran an analysis (Appendix 2) which shows the likely impact of a reduction in tax credits over a period of 12 or 24 months, on salaries from €21,000 to €115,000 to meet any liability arising from the receipt of the COVID Pandemic Unemployment Payment or the Temporary Wage Subsidy Scheme.

Speaking of the update, Marian Ryan, Consumer Tax Manager, Taxback.com,

“Many full-time workers are beginning to realise that being in receipt of either the COVID PUP or the TWSS will most likely lead to a build-up of a tax liability at the end of the year, even though their income may have reduced or stayed level. The employers and individuals that we have spoken with are, understandably, becoming increasingly concerned about how much extra tax will have to be paid and how it will be collected. There may be some solace in the confirmation that it will effectively be collected in increments over time – perhaps 1 or 2 years. But while the term “reducing tax credits” might not mean anything to people, it’s important that workers understand that it will ultimately mean a reduction in weekly or monthly take home pay during that period. We’ve run some numbers to give both employers and employees a better understanding of how it could impact them – for example, an average worker on a salary of €38,000, will find the following changes to how much income tax they pay**.”

Taxback.com say that although the Minister’s response suggests a person’s unused tax credits could substantially reduce or eliminate any tax liability that may arise, this is unlikely to be the case for most workers.

Ms. Ryan explained, “Anyone whose total 2020 employment income and TWSS/PUP is under €16,500 will have no PAYE liability and a tiny USC liability (between 0.5% and 2% of the TWSS/PUP Payment). But anyone with earnings above that will have to repay the tax. Someone on a salary of €38,000 for example, could face a liability of anywhere from €796 – €1972 – and it’s unlikely that unused credits would make much of a dent in this.

The Minister points in particular to the use of medical expense tax relief entitlements to reduce this tax bill. We absolutely agree that medical expense relief is underutilised in this country, and we are always calling on more people to get what they are owed in that regard. That said however, relief on medical expenses is 20% so to clear an underpayment of say €1,300, a person would need to have €6,500 in medical bills. In general, a person might only spend an average of €200-€250 per year on doctor visits and possibly some medicine.”